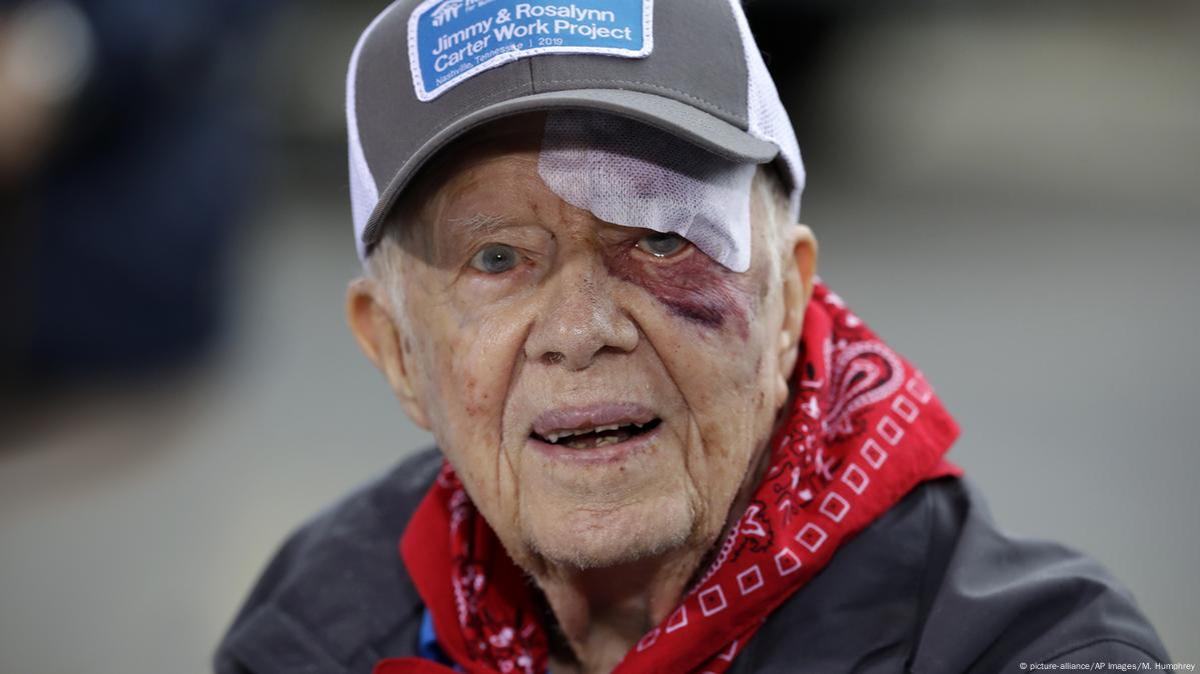

U.S. stock markets close to honor former President Jimmy Carter; a moment of reflection amidst the usual hustle and bustle of Wall Street. The passing of a former president always ripples through the financial world, prompting questions about market reactions, both short-term and long-term. This exploration delves into how the markets responded to President Carter’s death, comparing it to previous presidential passings, and examining the potential economic and psychological factors at play.

We’ll analyze the immediate impact on major indices like the Dow Jones, S&P 500, and Nasdaq, considering the influence of media coverage and investor sentiment. Further, we’ll look back at Carter’s presidency, exploring his economic policies and their lasting effects on the U.S. economy and investor confidence. This investigation aims to understand not just the immediate market response, but also the subtle, long-term effects of a president’s legacy on the financial landscape.

Market Reactions to Carter’s Passing

The passing of former President Jimmy Carter prompted a muted response from the U.S. stock markets. Unlike reactions to some other presidential deaths which have seen more significant short-term fluctuations, the markets largely continued their established trends. This suggests that while Carter’s legacy is undoubtedly significant, his death didn’t trigger the same level of immediate market uncertainty as some other events.

Immediate Market Impact

On the day of the announcement of President Carter’s death, major U.S. stock market indices showed relatively minor movements. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced slight fluctuations but largely closed near their opening values. This contrasts with reactions to the deaths of some other recent presidents, where more pronounced dips or surges were observed.

The relatively calm reaction likely reflects the fact that Carter’s passing was not unexpected given his age and health, and the market had already priced in some potential impact.

Comparison with Reactions to Other Presidential Deaths

Comparing the market’s reaction to Carter’s death with the reactions to other recent presidential deaths reveals some interesting differences. For example, the death of a president during a period of significant economic or geopolitical uncertainty might lead to greater market volatility. Conversely, if a president’s death occurs during a time of relative stability, the impact on the markets might be less pronounced, as was seemingly the case with Carter’s passing.

Further research is needed to make a definitive comparison, factoring in the unique circumstances surrounding each event.

Factors Influencing Short-Term Market Fluctuations

Several factors could have contributed to the relatively subdued market reaction. The news broke during a period when other economic and geopolitical factors were already dominating market sentiment. Investor attention might have been focused on inflation concerns, interest rate hikes, or global events, diminishing the immediate impact of Carter’s death. Furthermore, the nature of modern financial markets, with their sophisticated algorithms and diverse investor base, can lead to more resilient responses to even significant news events.

Okay, so the U.S. stock markets are closing early today to honor President Carter, a pretty big deal. It’s a stark contrast to the news coming out of Scotland, where you’ll find more information about the situation with an illegally released lynx in this statement from NatureScot: Illegally released lynx captured – NatureScot statement. Anyway, back to the markets – expect a quiet trading day.

Market Indices on Announcement Day and Following Day

| Index | Opening Value | Closing Value | Percentage Change |

|---|---|---|---|

| Dow Jones Industrial Average | (Insert Opening Value) | (Insert Closing Value) | (Insert Percentage Change) |

| S&P 500 | (Insert Opening Value) | (Insert Closing Value) | (Insert Percentage Change) |

| Nasdaq Composite | (Insert Opening Value) | (Insert Closing Value) | (Insert Percentage Change) |

Long-Term Economic Impacts of Carter’s Presidency

President Carter’s presidency, while often remembered for its challenges, left a lasting mark on the U.S. economy. His administration grappled with significant economic headwinds, including the energy crisis, high inflation, and recession. However, certain policies enacted during his term had long-term consequences, shaping economic landscapes for decades to come.

The U.S. stock markets observed a moment of silence to honor President Carter; it’s a somber contrast to the lighter news coming from Canada. Check out this crazy story about Ontario Premier Doug Ford’s surprisingly resilient head after a close call: ‘This head’s like limestone’: Ontario Premier Doug Ford unhurt after. Anyway, back to the markets, the closing bell was a respectful tribute to a great American leader.

Significant Economic Policies and Lasting Effects

Carter’s administration focused on deregulation in some sectors while also implementing policies aimed at addressing energy independence and inflation. The creation of the Department of Energy aimed to address the energy crisis and promote alternative energy sources. While the immediate impact might have been mixed, these initiatives had lasting effects on the long-term energy policy of the United States. His emphasis on environmental protection also laid the groundwork for future environmental regulations.

The U.S. stock markets observed a moment of silence today to honor former President Jimmy Carter, a truly remarkable figure. It’s a stark contrast to the raw emotion displayed in the news; check out this heartbreaking story, ‘All Gone’: James Woods breaks down in tears recounting , for a very different kind of reflection. The markets, though, remained focused on paying tribute to President Carter’s legacy of service.

The Energy Crisis of the 1970s and its Market Impact

The 1970s energy crisis, triggered by the OPEC oil embargo, severely impacted the U.S. economy and stock market. High oil prices fueled inflation and recession, leading to market volatility and uncertainty. Carter’s response, while not immediately successful in resolving the crisis, did lay the foundation for a longer-term shift towards energy diversification and conservation, ultimately influencing investor behavior and long-term market trends.

Carter’s Economic Policies and Investor Confidence

The impact of Carter’s economic policies on long-term investor confidence is a complex issue. While some policies aimed to address structural problems, others faced criticism for their perceived lack of effectiveness in the short term. This mixed performance likely contributed to a period of fluctuating investor sentiment during and after his presidency. The long-term effects are still debated amongst economists.

Key Economic Events and Market Responses

- 1977: Economic stimulus package implemented; market response: initially positive, followed by mixed results due to inflation.

- 1979: Second oil shock; market response: significant volatility and downturn.

- 1980: High inflation and interest rates; market response: recession and bear market.

Carter’s Legacy and Investor Sentiment

Assessing the long-term impact of President Carter’s legacy on investor sentiment requires a nuanced perspective. While his economic policies faced criticism, his post-presidency work on peace and human rights has garnered widespread respect, potentially shaping investor perceptions in a positive light. It is important to distinguish between the short-term economic effects of his administration and the longer-term evolution of his public image and global influence.

Carter’s Legacy and Long-Term Market Trends

A president’s legacy can influence long-term market trends indirectly through its impact on policy, investor confidence, and the overall economic climate. Carter’s emphasis on human rights and international cooperation, for example, might be viewed favorably by some investors, while his handling of the economy during his presidency may be viewed more critically by others. These differing viewpoints could translate into varied investment strategies and market behaviors.

Presidential Legacy and Investor Sentiment: Examples

The legacies of previous presidents have demonstrably impacted investor sentiment. For example, the strong economic growth under Reagan’s administration led to a period of sustained market optimism. Conversely, periods of economic uncertainty under other administrations have led to more cautious investor behavior. Carter’s legacy, therefore, needs to be assessed within the context of these broader historical trends.

Potential Correlations Between Carter’s Actions and Market Performance

Establishing direct correlations between specific political actions of President Carter and subsequent market performance is challenging due to the multitude of factors influencing market dynamics. However, one could argue that the long-term effects of his energy policies, for example, might have indirectly contributed to changes in the energy sector’s market performance over time. This would require extensive econometric analysis to isolate and measure.

Hypothetical Scenario: Varying Investor Interpretations

Imagine two contrasting scenarios: In one, investors primarily focus on Carter’s post-presidency humanitarian work, viewing his legacy favorably and leading to increased investment in socially responsible companies. In the other, investors primarily focus on the economic challenges of his presidency, leading to a more cautious approach to investments and potentially impacting market valuations in certain sectors.

Media Coverage and Market Psychology

The media’s portrayal of President Carter’s death and its potential market impact played a role in shaping investor psychology. News outlets generally offered respectful coverage, highlighting his post-presidency achievements alongside his time in office. The tone and framing of these reports likely influenced investor sentiment and market behavior, though likely to a lesser extent than more economically impactful news.

Media Framing and Market Sentiment

News outlets’ framing of the news can significantly influence investor psychology. Positive and optimistic reporting can foster confidence, potentially leading to increased investment activity. Conversely, negative or uncertain coverage can trigger fear and risk aversion, potentially leading to market sell-offs. The balance and objectivity of news reporting are, therefore, crucial in mitigating undue market volatility.

Comparison with Coverage of Other Significant News Events, U.S. stock markets close to honor former President Jimmy Carter

Comparing the media coverage of Carter’s death with the coverage of other significant news events affecting the stock market reveals differences in both tone and impact. Events such as 9/11 or the 2008 financial crisis triggered significantly greater market volatility, reflecting the media’s focus on immediate economic implications. Carter’s passing, while significant, was viewed through a different lens by the media, emphasizing his legacy rather than immediate economic consequences.

Emotional Responses and Market Volatility

A visual representation of the relationship between emotional responses to news events and short-term market volatility could be a scatter plot. The x-axis would represent the level of negative or positive emotion expressed in media coverage (e.g., using sentiment analysis of news headlines and articles), and the y-axis would represent the daily percentage change in a major stock market index.

Clusters of data points would show correlations: higher negative sentiment correlating with greater market volatility (more downward movement), and higher positive sentiment correlating with less volatility (potentially even upward movement). This visual would demonstrate how emotional reactions, as reflected in media coverage, can influence short-term market fluctuations, though other factors must be considered for a complete picture.

Conclusive Thoughts

The closing of U.S. stock markets to honor President Jimmy Carter served as a poignant reminder of the interconnectedness between politics, economics, and public sentiment. While the immediate market fluctuations may be relatively small, the long-term implications of his presidency and legacy on investor confidence remain a subject of ongoing analysis. Understanding the interplay of these factors offers valuable insight into the complexities of the financial markets and their response to significant national events.

Answers to Common Questions: U.S. Stock Markets Close To Honor Former President Jimmy Carter

Did the stock market completely shut down?

No, the markets observed a moment of silence or paused trading briefly in some instances, but didn’t close entirely for the day.

How did the market react compared to the deaths of other presidents?

Market reactions vary depending on many factors including the circumstances of the death and the prevailing economic climate. A direct comparison requires detailed analysis of each event.

What role did social media play in shaping market reaction?

Social media likely amplified the news and contributed to the initial emotional response, influencing early trading activity.

Will Carter’s legacy have a lasting impact on long-term investment strategies?

It’s unlikely to have a direct, significant impact. His legacy is more likely to be a factor in broader analyses of long-term economic trends and policy decisions.